by OrganicCrops. Posted on 15 July 2024, 08:12 hrs

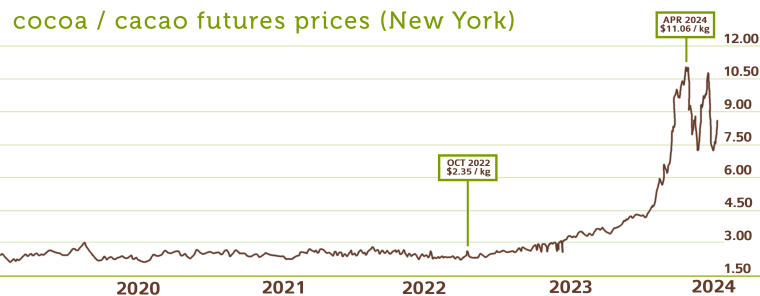

The price of cacao/cocoa has surged dramatically over the past year, leading to significant increases in the cost of chocolate. This rise can be attributed to several key factors affecting both supply and demand in the global cacao market, including issues specific to Peruvian cacao production.

One of the primary drivers of the cacao price increase is climate change. Cacao trees, which are highly sensitive to weather changes, have been severely impacted by extreme weather conditions. West Africa, responsible for around 75% of the world’s cacao production, has experienced heatwaves, intense rains, and droughts. The El Niño phenomenon has exacerbated these conditions, causing unpredictable weather patterns that have reduced harvests significantly.

In Ghana, one of the largest cacao producers, the cacao industry has faced numerous challenges. Illegal gold mining, smuggling, and crop diseases such as the cacao swollen shoot virus have all contributed to lower yields. These issues forced Ghana to close its cacao season early in 2023, reducing the available supply of cacao beans.

Investor speculation has also played a significant role in driving up cacao prices. Non-commercial investors now hold a substantial portion of cacao futures, leading to increased market volatility. This speculation, combined with structural issues like underinvestment in cacao farms and aging cacao trees, has created a perfect storm that has driven prices to record highs.

Although Peruvian cacao production has not been directly impacted by the extreme weather conditions that have plagued West Africa, prices in Peru have increased significantly due to the global nature of the cacao market. The price of Peruvian cacao is largely determined by the traded cacao futures price. Traditionally, the price of raw material is calculated as the NY futures price plus $0.25 per kilogram. As a result, Peruvian cacao prices have surged from around USD 7 per kg for regular organic cacao butter to approximately USD 25 per kg.

This price increase presents a significant challenge for the industry, as stakeholders are concerned about whether consumers will be able or willing to pay the much higher prices for cacao derivatives and chocolate.

The surge in cocoa prices has not only affected producers but also traders. According to a recent report, traders are facing potential losses of up to $1 billion due to the faltering cocoa supply. This financial strain adds another layer of complexity to the market, as traders struggle to manage costs while ensuring a steady supply of cocoa products to meet global demand.

The future of cacao prices remains uncertain. Several factors will influence the market over the next few years:

Maritza Zúñiga Cueva, Product Manager at OrganicCrops, projects that prices may drop somewhat in the next 1-2 years, potentially stabilizing around USD 6-7 per kg. However, she does not believe prices will ever return to the previous levels of USD 2-3 per kg due to the lasting impacts of climate change and market dynamics.

The significant increase in cacao prices is a complex issue driven by climate change, market dynamics, and structural issues within the industry. While the Peruvian cacao market has not faced the same direct impacts as West Africa, it has not been immune to the global rise in prices. Looking forward, the industry must navigate these challenges to stabilize prices and ensure the continued availability of chocolate at reasonable prices.

For more insights and updates on the cacao market, stay tuned to our resources at OrganicCrops.

Photo's by Julia Zyablova, Tetiana Bykovets, and Mario Heller on Unsplash.